Submit

Submit feedback

Forged Wheel Factory: Navigating the Global Aluminum Supply Chain and Logistics of Forged Wheel Distribution

2025-05-28

Forged aluminum wheels depend heavily on the availability and quality of raw aluminum. The global aluminum supply chain, therefore, plays a pivotal role in the production timeline, cost structure, and strategic planning of any forged wheel factory.

1. Raw Material Sourcing and Market Volatility

Aluminum is the third most abundant element in the Earth's crust, but the process of refining bauxite ore into usable aluminum is energy-intensive and geographically constrained. The major producers of aluminum include China, Russia, Canada, Australia, and India. Many forged wheel manufacturers rely on a consistent supply of aluminum ingots or billets sourced from these regions.

However, the global aluminum market is often subject to price volatility due to geopolitical tensions, trade tariffs, energy costs, and environmental regulations. Additionally, the push for greener energy sources has led to stricter carbon emissions standards in smelting operations, further influencing production costs and availability.

Such volatility can significantly impact forged wheel production. Higher aluminum prices increase material costs, which are often passed down the supply chain, affecting pricing and margins. In severe cases, manufacturers may face delays or be forced to source from alternative, sometimes less reliable, suppliers.

2. Supply Chain Resilience and Strategic Sourcing

To mitigate these challenges, many forged wheel factories have adopted a strategy of diversified sourcing. This means maintaining relationships with multiple suppliers across different regions to reduce dependency on any single source. Some manufacturers are also investing in recycling operations to reclaim aluminum from scrap, contributing to both cost efficiency and environmental sustainability.

Long-term contracts with aluminum producers, inventory buffering, and hedging strategies in the commodities market are additional ways manufacturers attempt to stabilize costs and ensure continuous production.

Once manufactured, forged aluminum wheels must be distributed through a complex network of dealers, retailers, and end users.

Forged wheels often start their journey in dedicated production facilities, typically located in Asia (especially China and Taiwan), Europe, or North America. After machining, surface treatment, and quality inspection, the wheels are packaged for shipment.

Distribution strategies vary depending on whether the wheels are sold to original equipment manufacturers (OEMs), aftermarket retailers, or direct-to-consumer (DTC) channels. Bulk shipments to OEMs are usually handled via container shipping to assembly plants, whereas aftermarket and DTC sales rely more on air and ground freight logistics.

Customs clearance, import duties, and regulatory compliance (such as JWL/VIA in Japan) must all be accounted for, particularly when distributing across international borders. These factors can add time and cost to the shipping process.

To respond quickly to customer demand, many wheel manufacturers operate regional distribution centers. These centers serve as hubs for order fulfillment, stock replenishment, and customer service. Strategic placement—close to major transport routes or consumer markets—helps reduce delivery lead times.

For DTC brands, efficient inventory management is essential to balance stock levels with fluctuating demand while minimizing warehousing costs. Many use predictive analytics to forecast sales trends and optimize stock rotation.

Additionally, customized forged wheels, which are often made to order, present further logistical challenges. These orders require careful scheduling to align production timelines with shipping availability while still meeting customer expectations for delivery.

In the case of international shipping, the risk of damage increases due to multiple handling points. Any mishandling can lead to returns, reputational damage, and financial losses. Therefore, partnerships with reliable logistics providers are crucial to maintaining product integrity.

recommend products

-

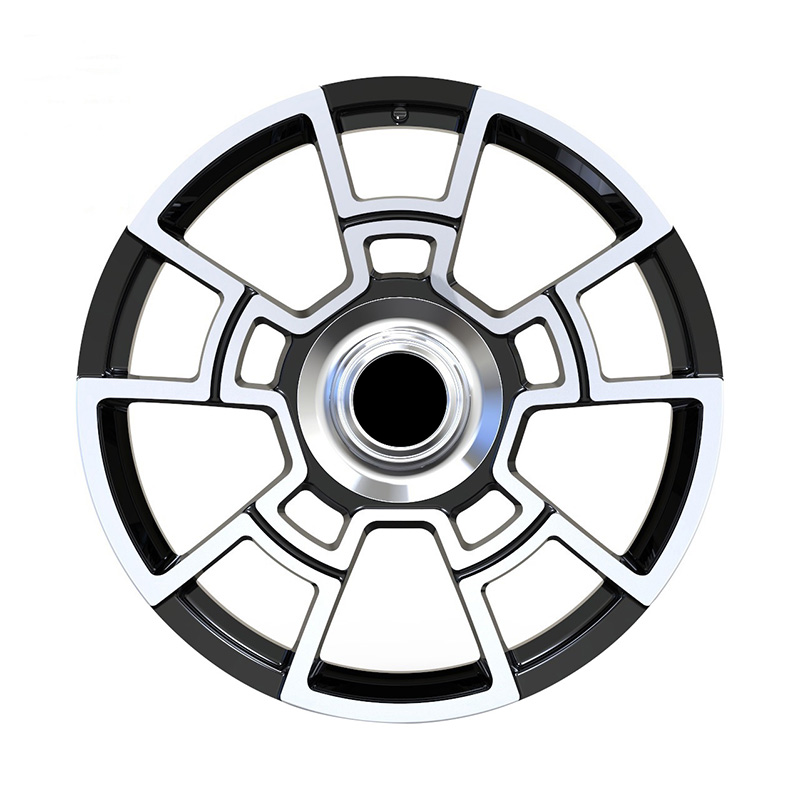

Zhenlun Multi Spokes Split Monoblock Forged Wheels Bronze With Silver Lip Edge

-

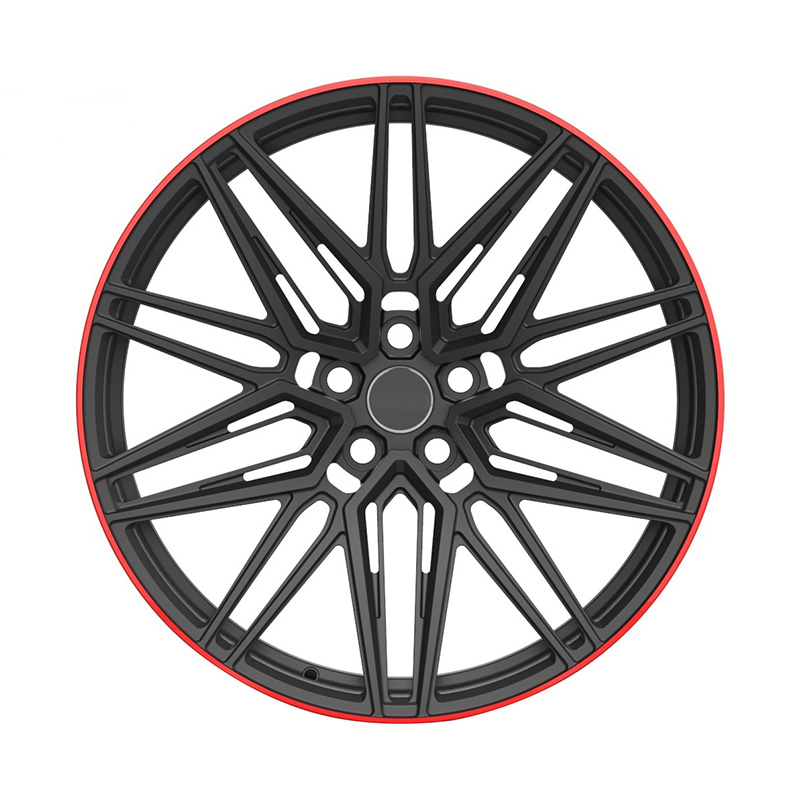

Zhenlun Matt Black With Red Lip Monoblock Forged Wheels

-

Zhenlun Gloss Black Monoblock Forged Wheels Gloss Black For Sports Car

-

Zhenlun Monoblock Forged Wheels Lightgrey With Machined Face

-

Zhenlun Monoblock Forged Wheels Gloss Black Dense Multi Spoke

0

0